The president of Fedesmeraldas points out that although the production of the stone has dropped, the international price allows them to maintain their leadership.

The first half of 2018 was a period of contrasts for the country’s emerald industry. First, there was a 4% gem value growth in exports reaching destinations such as India, China, the US and Europe, exceeding US $73 million.

However, compared to the first half of 2017, exports fell by 6%, represented by a difference of just over US $4 million due to the decrease in emerald production in the national territory.

Oscar Baquero, president of the National Federation of Emeralds (Fedesmeraldas), explained that the business is still in a growth stage since it represents about US $150 million a year, compared to other extractive industries that move close to the US $2 billion annually.

Are Colombian emeralds still attractive in international markets?

Colombian emeralds are leaders in remembrance throughout the world market. They are desired for their color, size and transparency. Less than 10 years ago, national gems were iconic in the world. There was no bigger producer of emeralds than Colombia. Since the 1950s we have been the main producers.

What is Colombia’s participation in the global emerald business?

Colombia ranks third in participation in the world emerald business. First there is Zambia with a production of 30 million carats, followed by Brazil with 4 million carats, and then us with 2 million carats. But this volume is exceeded in value compared to the other two countries.

The added value of the gem is in its physical and chemical properties …

Although Zambia and Brazil surpass us in production by quantity of carats, the one with the highest value due to its unique physical and chemical characteristics is the Colombian one. The quality of the Colombian emerald is superior to the gems produced by Zambia and Brazil.

What are these physical and chemical characteristics?

The color of emerald is made up of three chemical elements which are chromium, vanadium and iron. However, in the Colombian gem, which is much more alive, the first two elements predominate, which help to raise the level of its quality, which makes it unique worldwide. Iron darkens the stones and reduces their quality

How is the emerald business in Colombia?

The Colombian emerald business is still growing, representing about US $150 million a year, compared to other extractive industries that move about US $2 billion annually. However, that amount is very representative in the international market because the national gem is the highest value and the most desired in the world.

Despite the drop in production, is the level of its commercialization maintained?

Yes, there has been a drop in the production of emeralds in the country and between 7% and 8% are no longer being placed in the markets, but paradoxically the profitability increases thanks to the price and the quality of the gem. Despite this decrease, Colombia maintains world leadership in terms of stone sales.

What is the balance of the operation in the first six months of the year?

At the end of the first semester, sales of Colombian emeralds in international markets were US $74 million, which although it was somewhat small, when compared to metals such as gold or silver; The level of its commercialization was notorious worldwide.

What was the percentage with which the national gem was valued in international markets?

Between January and June there was a growth in the value of the Colombian gem of 4% in world markets, and exports reached destinations such as India, China, the United States and Europe.

Are Boyacá and Cundinamarca still focusing on the operation?

Colombia has great potential in emerald production issues. Data from the union report that there are about 100,000 hectares located in the departments of Boyacá and Cundinamarca that have potential in terms of veins. Today there are new regional conditions that have opened the space for the arrival of foreign investment.

What are the companies that are managing the operation?

The great iconic Muzo mine is being operated by the multinational Minera Texas Colombia, which has advanced an industrialization and modernization process in the complex. The Coscuez mine is in the hands of the Canadian Fura Gems and the Maripí project is managed by the Colombian Esmeraldas Santa Rosa. There is a small artisan operation that is in the process of being formalized.

What are the benefits that the industrialization of the operation has brought in the area?

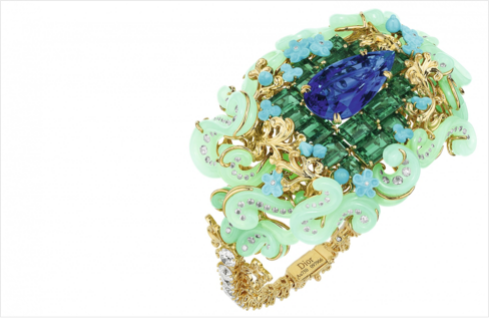

The emerald industry has remained a catalyst for the regional and national economy, generating more than 3,000 direct jobs and nearly 12,000 indirect jobs. We are facing a new era for emeralds in Colombia thanks to its transformation into economies of scale, since not only does there exist a series of social and investment conditions that favor the industry, but also the leadership that Colombia has in exporting Carved stones as an input for the great jewelry houses in the world, shows a clear panorama for the strengthening of this activity in all aspects.